Banking and Finance

Bank of Ghana Cracks Down on Remittance Violations Amid Forex Stability Drive

The Bank of Ghana (BoG) has issued a stern warning to financial institutions and money transfer operators over persistent breaches of the country’s foreign exchange laws and remittance guidelines.

In a public notice dated July 29, 2025, the central bank said it has observed ongoing non-compliance with the Foreign Exchange Act, 2006 (Act 723), as well as the Updated Guidelines for Inward Remittance Services, despite repeated warnings.

Among the violations identified are the termination of inward remittances through unapproved channels, unauthorised foreign exchange swaps related to remittance operations, processing remittances for unapproved institutions, and the use of unprescribed foreign exchange rates.

“The Bank will impose sanctions on any institution found culpable and terminate the remittance partnerships of all money transfer operators whose activities are inconsistent with the approved guidelines,” the statement cautioned.

The BoG also emphasized the need for strict adherence to existing protocols, including the funding of local settlement accounts in line with Section 7.1 (c) of the guidelines, and disbursing all funds through these accounts as required under Section 7.2 (a). DEMIs and Enhanced Payment Service Providers (EPSPs) must ensure that their pre-funding arrangements with settlement banks comply with Section 7.2 (b).

To strengthen transparency and oversight, the Bank has mandated that all banks, DEMIs, and EPSPs submit weekly reports on each MTO. These reports must include a daily breakdown of all inward remittance transactions and details of the foreign exchange credited to their Nostro accounts.

The BoG stressed that failure to submit accurate and timely reports constitutes a regulatory infraction under Section 42 of the Payment Systems and Services Act (Act 987) and Section 93(3)(d) of the Banks and Specialised Deposit-Taking Institutions Act (Act 930), and will attract appropriate administrative penalties.

This directive signals a renewed push by the central bank to tighten regulatory oversight in the remittance and foreign exchange sectors, as part of broader efforts to ensure forex market stability and enhance economic recovery.

Banking and Finance

President Mahama Opens Cedi @ 60 Conference, Highlights Ghana’s Economic Resilience and Currency Progress

President Mahama Opens Cedi @ 60 Conference, Highlights Ghana’s Economic Resilience and Currency Progress

President John Dramani Mahama on Monday officially opened the Cedi @ 60 International Currency Conference in Accra, describing the gathering as “a historic assembly of leaders, innovators, policymakers and practitioners whose work influences the past, present and future of money.”

In his keynote address, President Mahama commended the Bank of Ghana and the currency research team for convening “such a distinguished community to discuss the evolving framework for currency management, monetary governance and digital finance.”

Reflecting on the significance of Ghana’s national currency, the President noted that the cedi, introduced 60 years ago, was “not merely a unit of account or a medium of exchange, but as a Declaration of Independence, our identity and the capacity of our state.” He added, “Over 60 years now, the cedi has anchored the conduct of our monetary policy. It has shaped the expectations of households and businesses, absorbed shocks—domestic, regional and global—and symbolized the resilience of the Ghanaian economy and the Ghanaian people.”

President Mahama emphasized that the conference is both a celebration and a moment for analysis. “It is a chance to consider what our currency stands for, how it has developed and how it must be fortified for the years ahead,” he said.

Highlighting Ghana’s recent economic gains, the President pointed to “macroeconomic stabilization through disciplined fiscal consolidation, increased domestic revenue mobilization, prudent expenditure rationalization, and better coordination between fiscal and monetary authorities,” which have helped restore balance and reduce uncertainty.

He also acknowledged improvements in the cedi’s performance, saying, “Improved Forex liquidity management, enhanced reserve buffers, and regulatory reforms have contributed to significant exchange rate stability, which is critical for business planning, investment decisions and public confidence.”

Noting Ghana’s strengthened economic credibility, President Mahama highlighted that “Ghana’s sovereign rating by S&P was upgraded recently from CCC+ to B- with a stable outlook on 7th November 2025. This is an affirmation that our fundamentals are strengthening and that we’re on a clear path of recovery.”

On the independence of the Bank of Ghana, the President was unequivocal: “A strong and autonomous central bank is essential for anchoring inflation expectations, maintaining exchange rate stability, enhancing investor and market confidence, and ensuring long-term policy credibility. This is not a matter of personal preference. It is an economic necessity.”

President Mahama further urged the Bank of Ghana to enhance nationwide public education, focusing on promoting the use of the cedi, improving currency handling practices, and strengthening financial literacy across all sectors of society. “An informed citizenry is better able to prevent fraud, demand accountability, and bolster the financial ecosystem,” he said.

On Ghana’s role in regional finance, the President highlighted the Pan-African Payment and Settlement System (PAPSS), emphasizing its potential in facilitating seamless trade under the African Continental Free Trade Area.

Concluding his address, President Mahama declared: “As we commemorate the cedi at 60, let us commit ourselves to shaping a currency and an economy that reflects the hopes and aspirations of our people… It is now my singular honor to declare the Cedi @ 60 International Conference duly opened.”

Banking and Finance

BoG Governor: Ghana’s Economic Recovery Proves Credibility and Discipline Can Restore Stability

The Governor of the Bank of Ghana (BoG), Dr. Johnson Pandit Asiama, says Ghana’s strong economic rebound shows that credibility, transparency and disciplined policy reforms can restore stability even after a major financial crisis.

Speaking at the opening of the maiden Pan-African Central Bank Governors’ Conference in Accra on Monday, Dr. Asiama recalled that just three years ago the country was battling what the World Bank described as a “homegrown crisis.”

“Inflation had soared to 54.1 percent, the cedi had lost half of its value, and reserves had dropped to less than one month of import cover,” he recounted.

“When my team assumed office in 2025, we chose one mission — stabilisation. We tightened policy, sterilised excess liquidity, and communicated openly with the public, the markets and citizens.”

A Recovery Backed by Data

He noted that these measures have yielded significant results. Inflation has now dropped to 8 percent — the first time Ghana has returned to single-digit inflation since 2021.

The country’s international reserves have also improved, reaching $11 billion, enough to cover 4.8 months of imports as of September 2025. Additionally, the cedi has appreciated by more than 34 percent year-to-date, reversing last year’s depreciation.

“Our stability is real, but still young — it is still being tested,” Dr. Asiama cautioned.

“Credible communication and sustained fiscal discipline will be key to protecting these gains.”

Pan-African Conference on Central Banking

The two-day high-level conference is being hosted by the Bank of Ghana in partnership with the Bank of England and the UK Foreign, Commonwealth and Development Office (FCDO).

Held under the theme:

“Central Bank Governance: Leadership, Credibility and Resilience in African Central Banking,”

the event brings together leaders of 23 African central banks to discuss policy independence, governance and regional financial stability.

Notable attendees included:

-

British High Commissioner to Ghana, Dr. Christian Rogg

-

Deputy Governor for Monetary Policy at the Bank of England, Clare Lombardelli

-

First Deputy Governor of BoG, Dr. Zakari Mumuni

-

Second Deputy Governor of BoG, Matilda Asante-Asiedu

Collaboration and Peer Learning

Dr. Rogg praised the growing cooperation among African central banks, noting that shared learning is now key in addressing inflation, debt risks and global market instability.

He emphasized that the partnership between the Bank of Ghana and the Bank of England — which began in 2015 — has evolved from aid-oriented support into a knowledge-sharing model that strengthens financial governance and resilience.

Ms. Lombardelli added that the Bank of England remains committed to supporting central banks across the Global South through training, research collaborations and initiatives such as the UK and international market funding programmes.

Banking and Finance

Weakening U.S. Dollar Boosts Ghana Cedi Amid Forex Pressures – Bank of Ghana

The Bank of Ghana says the recent decline in the value of the U.S. dollar has played a major role in supporting the Ghana Cedi, helping to steady the local currency despite continued challenges in the foreign exchange market.

According to the Central Bank, the U.S. dollar index fell by about 8 percent between January and August 2025. This was largely due to a slowdown in the American labour market and growing expectations that the U.S. Federal Reserve would begin cutting interest rates.

In its September 2025 Monetary Policy Report, the Bank explained that the weaker dollar, along with the increasing global use of alternative currencies like the Chinese Yuan for trade and commodity payments, contributed to the strengthening of several emerging market currencies — including Ghana’s cedi.

However, the local currency still faced headwinds during the period, mainly from high import demand and reduced foreign exchange supply. These challenges were linked to issues in the Gold-for-Forex programme and a dip in remittance inflows.

Despite these pressures, the Cedi recorded notable gains — appreciating by 28.95 percent against the U.S. dollar, 19.49 percent against the British pound, and 14.08 percent against the euro on a year-to-date basis. This marks a sharp turnaround from the significant losses seen during the same period in 2024.

The Bank of Ghana noted that the Cedi’s short-term stability will rely on maintaining high gold prices, improving forex liquidity through new directives to mining companies, and ensuring continued fiscal discipline.

Additionally, positive investor confidence from the recent IMF programme reviews and shifts in U.S. monetary policy are expected to further influence the Cedi’s outlook in the coming months.

-

Entertainment2 weeks ago

Entertainment2 weeks ago[EDITORIAL] Why Ayisi is not Getting the Expected Mileage in Ghana’s Music Industry

-

Entertainment1 week ago

Entertainment1 week agoThe Exposé that Redefined the Creative Vote: Inside Kojo Preko Dankwa’s Deep Dive into the Creative Arts Agency

-

Entertainment2 weeks ago

Entertainment2 weeks agoComedians are Chasing MC Roles: What Should Professional MCs Do?

-

Entertainment1 week ago

Entertainment1 week ago8 Events that Ignited Detty December in Ghana

-

Entertainment1 week ago

Entertainment1 week agoCreative Diplomacy in Limbo as PanAfrica–Ghana Awaits Government Response on Healing Africa Tour

-

Lifestyle1 week ago

Lifestyle1 week agoMost People Aren’t Afraid of Failure. They’re Afraid of Knowing Themselves

-

Culture12 hours ago

“We Entertain Stupidity in This Country” — GHOne’s Lilly Mohammed Slams Foreign Affairs Minister Ablakwa Over IShowSpeed Passport Saga

-

Entertainment5 days ago

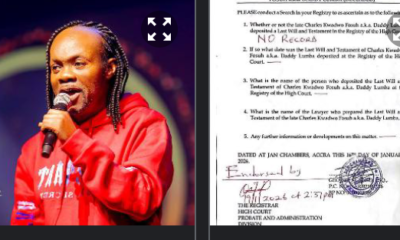

Entertainment5 days agoHigh Court Confirms No Will on Record for Late Highlife Icon Daddy Lumba