Uncategorized

AfDB Approves $474.6M Loan to Boost South Africa’s Transport and Energy Sectors

The African Development Bank (AfDB) has approved a $474.6 million loan to South Africa to help upgrade its transport and energy infrastructure. This marks the second major infrastructure loan for the country in recent weeks, following a $1.5 billion agreement with the World Bank in June.

The AfDB’s financial support is aimed at enhancing energy efficiency and implementing critical rail sector reforms, the bank said in a statement on Tuesday.

South Africa, Africa’s most industrialized economy, has been grappling with persistent power outages, deteriorating railway networks, and heavily congested ports for over a decade. These issues have severely impacted key sectors such as mining and automobile manufacturing, stalling economic growth.

The AfDB loan is part of a broader international financing package to support South Africa’s infrastructure revival. Additional contributions include €500 million ($590.75 million) from German development bank KfW, up to $200 million from the Japan International Cooperation Agency (JICA), and $150 million from the OPEC Fund for International Development.

The combined effort signals a coordinated international commitment to revitalizing South Africa’s critical infrastructure and supporting long-term economic stability.

Uncategorized

Akonta Mining Operations Manager Granted GH¢10 Million Bail in Illegal Mining Case

An Accra court has granted bail in the sum of GH¢10 million to Kwadwo Owusu Bempah, Operations Manager of Akonta Mining, with three sureties, one of whom must be justified.

Mr. Owusu Bempah is the fifth accused person in an ongoing trial involving Akonta Mining and three others, including the Ashanti Regional Chairman of the New Patriotic Party, Bernard Antwi Boasiako, popularly known as Chairman Wontumi. The case centres on alleged illegal mining activities in the Tano Nimiri Forest Reserve.

Although earlier reports suggested that Mr. Owusu Bempah was on the run, his lawyer, Andrew Vortia, told the media that his client voluntarily presented himself to the police about three weeks ago. He was subsequently granted police enquiry bail but was re-arrested on Monday, January 12, 2026, for failing to report as required.

Appearing before the court on Wednesday, January 14, 2026, Mr. Owusu Bempah pleaded not guilty to charges of engaging in mining operations without a licence, abetting the unauthorised felling of trees, and abetting the unauthorised construction of structures within the forest reserve.

The prosecution maintains that Akonta Mining holds valid mining concessions at Samreboi and Abekoase in the Western Region, both located outside the Tano Nimiri Forest Reserve. However, an application by the company to mine within the reserve was rejected. Prosecutors allege that despite this refusal, Chairman Wontumi unlawfully entered the reserve, felled trees, and put up structures without authorisation.

According to the charge sheet, Chairman Wontumi, described as a shareholder representing Akonta Mining, and Edward Akuoko, the company’s General Manager, were arrested and arraigned before the court. Kwame Antwi, another shareholder, and Mr. Owusu Bempah were initially declared at large. While Mr. Owusu Bempah has since been arrested, Kwame Antwi remains at large.

Meanwhile, in November 2025, the state informed the court of its decision to withdraw charges against Edward Akuoko and to use him as a prosecution witness. The prosecution has also indicated plans to amend the charge sheet to formally remove Mr. Akuoko as an accused person.

Uncategorized

Police Arrest Five Suspected Kidnappers, Rescue Two Victims in Nsawam Operation

Police Arrest Five Suspected Kidnappers, Rescue Two Victims in Nsawam Operation

The Nsawam District Police Command has arrested five individuals in connection with the kidnapping of two men travelling from Accra to Anyinam, following a coordinated intelligence-led operation. The victims were rescued safely and are in stable condition.

Police reports indicate that on January 10, 2026, the Command received credible intelligence that the two men had been abducted and moved to an undisclosed location. The suspects allegedly demanded a ransom of GH¢400,000 from the victims’ family and later instructed them to make an initial payment of GH¢5,000.

Acting on the information, officers from the Nsawam District Police, with support from the Suhum Police Command, mounted an operation that led to the arrest of the suspects at a drinking spot near the Suhum Roundabout.

The suspects have been identified as Suleman Salifu, 24; Godfred Owusu, 26; Antwi Bismark, 27; Anas Salis, 38; and Gyamfi Isaac, 33. The victims, Seidu Sambiane, 28, and Ibrahim Alhassan, 42, were rescued during the operation without harm.

A search of an unregistered Acura 4×4 vehicle allegedly used by the suspects resulted in the recovery of several items, including forged GH¢100 and GH¢200 notes, specimen papers cut to the size of currency notes, and an amount of GH¢4,600 in cash. Police also retrieved a pistol, a cutlass, talismans and amulets, as well as five mobile phones.

The suspects are currently in police custody and are assisting with ongoing investigations as police prepare to take further legal action.

Uncategorized

GoldBod Denies Buying Gold from Illegal Miners, Explains Sourcing Process

The Ghana Gold Board, known as GoldBod, has rejected allegations that it buys gold from illegal miners, commonly called galamseyers.

In a set of frequently asked questions released on Monday, January 5, 2026, the board clarified that it does not purchase gold directly from miners. Instead, GoldBod buys gold only through licensed aggregators.

According to the statement, GoldBod’s role as a public corporation is guided by law. Under Section 3(1)(f) of Act 1140, the board is mandated to promote the formalisation of small-scale mining by ensuring responsible sourcing, a sustainable supply chain, full traceability of gold, and compliance with international standards. Another provision, Section 3(1)(g), requires the board to support environmentally responsible and sustainable mining practices.

GoldBod stressed that all gold-buying licenses it issues strictly prohibit licensed buyers from sourcing gold from illegal miners. These conditions, the board noted, are publicly available on its website.

To strengthen oversight and accountability, GoldBod revealed that it is developing a blockchain-based track-and-trace system. The system, which will verify the origin of every gram of gold bought from licensed buyers, is part of efforts to ensure responsible sourcing. The board noted that it has been in operation for only eight months.

The board also pointed to wider government actions against illegal mining, led by the National Anti-Illegal Mining Operations Secretariat, NAIMOS. These efforts have so far resulted in the eviction of illegal miners from nine forest reserves, the revocation of Legislative Instrument 2462 that allowed mining in forest reserves, restrictions on excavator imports, and the arrest and prosecution of offenders.

GoldBod explained that gold has been mined and traded in Ghana for decades without proper traceability. It said the establishment of the board marks the first time a state institution has been tasked with ensuring full value chain traceability within a defined timeframe.

The board dismissed criticism from political opponents, describing such attacks as attempts to discredit its progress in formalising the gold sector.

GoldBod concluded by reaffirming its commitment to ending illegal mining and confirmed that the blockchain track-and-trace system will be rolled out in 2026 after a competitive tender process.

-

Entertainment1 week ago

Entertainment1 week agoThe Exposé that Redefined the Creative Vote: Inside Kojo Preko Dankwa’s Deep Dive into the Creative Arts Agency

-

Entertainment1 week ago

Entertainment1 week ago8 Events that Ignited Detty December in Ghana

-

Entertainment2 weeks ago

Entertainment2 weeks agoComedians are Chasing MC Roles: What Should Professional MCs Do?

-

Entertainment1 week ago

Entertainment1 week agoCreative Diplomacy in Limbo as PanAfrica–Ghana Awaits Government Response on Healing Africa Tour

-

Lifestyle1 week ago

Lifestyle1 week agoMost People Aren’t Afraid of Failure. They’re Afraid of Knowing Themselves

-

Culture24 hours ago

“We Entertain Stupidity in This Country” — GHOne’s Lilly Mohammed Slams Foreign Affairs Minister Ablakwa Over IShowSpeed Passport Saga

-

Entertainment6 days ago

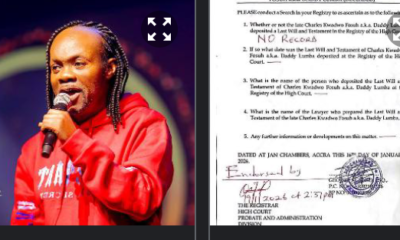

Entertainment6 days agoHigh Court Confirms No Will on Record for Late Highlife Icon Daddy Lumba

-

General News2 weeks ago

General News2 weeks agoAlpha Hour Demands Retraction and Apology from Bongo Ideas Over Alleged Defamatory Claims