Business

Fuel Prices Set to Drop from June 16 After Levy Suspension

Ghanaians can expect a drop in fuel prices starting Monday, June 16, 2025, following the government’s decision to suspend the proposed GH¢1.0 Energy Sector Levy. This comes as a relief to consumers and marks the seventh consecutive price reduction since mid-February.

The latest Pricing Outlook Report from the Chamber of Oil Marketing Companies (COMAC) indicates that the postponement of the levy is a key factor driving the anticipated price cuts.

Projected Prices at the Pump

According to data sourced from oil marketing firms and obtained by Joy Business, the new price of petrol is expected to be around GH¢11.77 per litre — representing a drop between 1.1% and 2.25% from prices recorded on June 1.

Diesel prices are set for a more significant decrease, falling by as much as 4.3% to about GH¢12.13 per litre. Likewise, Liquefied Petroleum Gas (LPG) will see a 3.2% dip, bringing the price per kilogram to GH¢13.30.

Why Are Prices Falling?

The Chamber attributes the downward trend primarily to the Ghana cedi’s continued appreciation against the US dollar. This currency strength has offset the impact of rising global oil prices, which surged amid renewed conflict in the Middle East.

Despite crude oil prices climbing to around $75 per barrel due to Israel’s military strikes on Iranian nuclear sites, Ghanaian fuel prices remain stable — for now. The situation, however, remains volatile.

Warning Signs for July

Officials at COMAC caution that if global oil prices continue to climb, fuel prices in Ghana could begin to rise again starting July 1, 2025.

Recent escalations in the Middle East have already caused oil prices to rise sharply, with Brent crude jumping 4.41% from $65.35 to $68.23 per barrel. These tensions have also prompted the United States to partially evacuate its embassy in Iraq, adding to global uncertainty.

As a result, international benchmark prices for petrol and diesel have risen by 1.03% and 3.94% respectively. In contrast, LPG prices dropped by 1.79%.

Impact of the Suspended Levy

COMAC’s projections suggest that had the government gone ahead with the additional GH¢1.0 Energy Sector Levy, consumers would have faced significant price hikes. Petrol would have surged by 9.1% per litre and diesel by 8.25%. LPG would have still seen a modest 2.29% decline, as it was not included in the levy’s scope.

The current suspension offers temporary relief, but stakeholders warn that sustained global instability may force a reversal of the current trend in the coming weeks.

Business

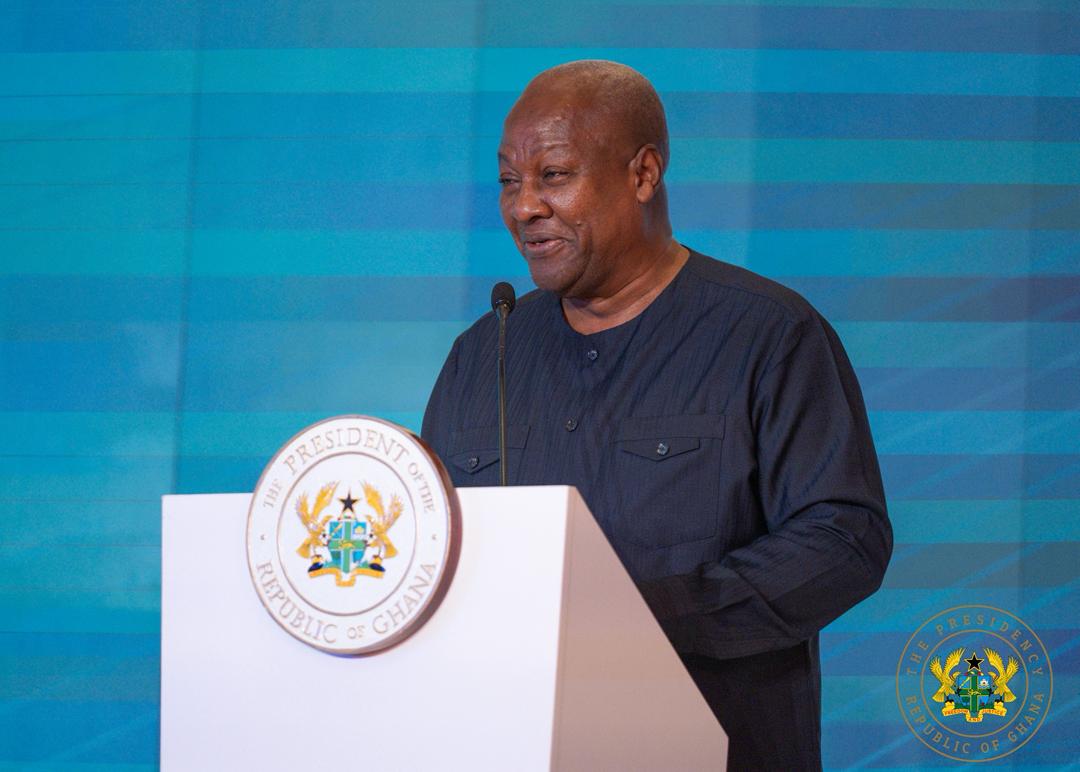

Africa must stop raw material exports – President Mahama

President John Dramani Mahama has urged African countries to bring an end to the export of raw materials, warning that the continent will continue to lose jobs, revenue and industrial capacity if it fails to add value to its natural resources.

Speaking at the Africa Trade Summit on Wednesday, President Mahama said Africa’s long-standing dependence on primary commodity exports had entrenched economic vulnerability and stunted industrial development.

“Africa cannot continue to export raw materials and re-import finished goods at many times their original value,” he said, describing the model as one that “exports wealth and imports unemployment.”

The President cited cocoa as a clear example of the structural imbalance facing African economies, noting that while Africa produces the majority of the world’s cocoa, it earns only a small share of the value generated by the global chocolate industry.

“This situation is not unique to cocoa,” he said. “We see the same pattern in oil, textiles, timber and mineral resources, where Africa remains at the bottom of the value chain.”

President Mahama stressed that industrialization on the continent must be anchored in value addition and beneficiation, arguing that processing Africa’s resources locally would create jobs, support technology transfer and expand domestic revenue.

Turning to Ghana’s experience, he said the country was deliberately shifting away from a commodity-export model towards a value-added economy. According to him, this strategy prioritizes agro-processing, manufacturing and industrial clusters aligned with Ghana’s natural endowments.

“Our focus is to add value to what we produce—cocoa, cashew, oil palm, cassava, petroleum, gold, manganese and bauxite—so that these resources can drive real economic transformation,” President Mahama said.

He added that value addition was also critical to the success of the African Continental Free Trade Area (AfCFTA), noting that meaningful intra-African trade would only be achieved if countries traded finished and semi-finished goods rather than raw materials.

“Beneficiation is not optional; it is essential if Africa is to industrialize, compete globally and secure prosperity for its people,” he said.

The Africa Trade Summit brings together heads of state, policymakers, business leaders and development partners to discuss strategies for boosting industrialization, strengthening regional value chains and expanding intra-African trade.

Business

President Mahama highlights ‘GoldBod’ Gains as Ghana reclaims resource control

President John Dramani Mahama on Wednesday 28th January, 2026 said Ghana’s recent reforms in the gold sector demonstrate how African countries can reclaim control over their natural resources while strengthening economic sovereignty.

Speaking at the Africa Trade Summit 2026, President Mahama argued that Africa must move away from what he described as a colonial-style system of resource extraction that benefits foreign interests at the expense of domestic development.

“On the issue of resource sovereignty, we must break the colonial mode of large, foreign-owned concessions that extract value for the benefit of foreign interests while Africa remains in poverty,” President Mahama said.

He urged African leaders to pursue policies that ensure their countries retain a fairer share of the value generated from natural resources, insisting that this approach is essential for sustainable development.

“We must be boldly selfish and claim a fairer share of our natural resource endowment,” he stated.

President Mahama cited the establishment of the Ghana ‘Goldbod’ as a key reform that has significantly improved oversight and foreign-exchange retention in the small-scale mining sector.

According to him, Ghana exported about 63 tonnes of gold from small-scale mining in 2024, but foreign-exchange repatriation accounted for only around 40 tonnes, meaning the proceeds from 23 tonnes of gold did not return to the country.

“That situation was unacceptable for a country seeking to build economic resilience,” Mahama noted.

He explained that since the Gold Board was established in April 2025, export volumes have increased while financial controls have been strengthened.

“Exports from the small-scale mining sector have now risen to 104 tonnes, and 100 per cent of the foreign exchange is being repatriated through the Bank of Ghana,” President Mahama said.

He described the outcome as clear evidence that resource sovereignty does not hinder production but instead enhances national benefits.

“This is what reclaiming resource control looks like in practice — higher exports, full value retention, and national ownership of our wealth,” he added.

The Africa Trade Summit 2026 brought together African leaders, policymakers, and business executives to discuss strategies for deepening intra-African trade, accelerating industrialisation, and strengthening economic self-reliance under the African Continental Free Trade Area (AfCFTA).

President Mahama’s remarks have renewed calls for African governments to review mining regimes and resource governance frameworks as part of broader efforts to transform the continent’s economies.

Business

Wealth Is Built After Work Hours, Mike Ohene-Effah Urges Goal-Focused Living in New Year Message

As a new year begins, many people are eager to turn their resolutions into real progress. According to Mike Ohene-Effah, Co-Founder and Lead of Afrique International, true success does not come from good intentions alone but from intentional planning, disciplined time use, and consistent personal development.

Speaking during the Effective Living series live on Citi 97.3fm on Tuesday, January 6, Mike emphasized the importance of managing time wisely and setting clear goals.

“You make income between 8 a.m. and 5 p.m. Wealth, however, is created between 7 p.m. and 8 a.m. That is when you truly create value for your future,” he said.

He explained that every day can be divided into three eight-hour blocks, sleep, work, and personal time. While most people plan for sleep and work, the personal time block is often wasted on distractions. Mike noted that using this period for learning, skill development, and personal growth can significantly change one’s life.

Three Levels of Goal-Setting

Mike outlined a simple but powerful framework for goal-setting, built around three levels.

Outcome goals describe what you want to achieve by the end of the year. These could include earning a specific income, completing a major project, or reaching a career milestone. However, outcome goals are often influenced by external factors and may not be fully within one’s control.

Performance goals focus on personal standards and how well tasks are executed. These goals are about improvement, consistency, and measurable progress, giving individuals greater control over their success.

Process goals are the daily habits and actions that lead to long-term results. These include routines such as studying, networking, practicing a skill, or working on key projects. Mike stressed that although people often avoid process goals because they require daily effort, they are the most important drivers of lasting change.

“Nothing in your life will change in 2026 if you do not change or improve,” he said. “Focus on what you can control, your daily actions, habits, and behaviours. That is where real wealth and success are built.”

The Power of the Hidden Hour

Mike’s central message focused on what he calls the hidden hour, the time outside regular work hours when real growth happens. While salaries are earned during the day, long-term wealth, knowledge, and mastery are built through deliberate effort during personal time.

By committing this hidden hour to focused growth and disciplined goal-setting, individuals can turn ordinary days into powerful building blocks for a more successful future.

-

Entertainment1 week ago

Entertainment1 week agoThe Exposé that Redefined the Creative Vote: Inside Kojo Preko Dankwa’s Deep Dive into the Creative Arts Agency

-

Entertainment1 week ago

Entertainment1 week ago8 Events that Ignited Detty December in Ghana

-

Entertainment2 weeks ago

Entertainment2 weeks agoComedians are Chasing MC Roles: What Should Professional MCs Do?

-

Entertainment1 week ago

Entertainment1 week agoCreative Diplomacy in Limbo as PanAfrica–Ghana Awaits Government Response on Healing Africa Tour

-

Lifestyle1 week ago

Lifestyle1 week agoMost People Aren’t Afraid of Failure. They’re Afraid of Knowing Themselves

-

Culture22 hours ago

“We Entertain Stupidity in This Country” — GHOne’s Lilly Mohammed Slams Foreign Affairs Minister Ablakwa Over IShowSpeed Passport Saga

-

Entertainment6 days ago

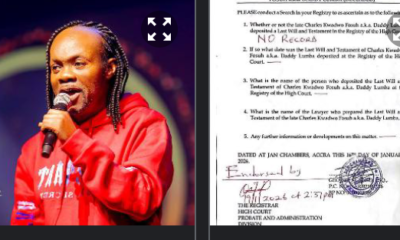

Entertainment6 days agoHigh Court Confirms No Will on Record for Late Highlife Icon Daddy Lumba

-

General News2 weeks ago

General News2 weeks agoAlpha Hour Demands Retraction and Apology from Bongo Ideas Over Alleged Defamatory Claims